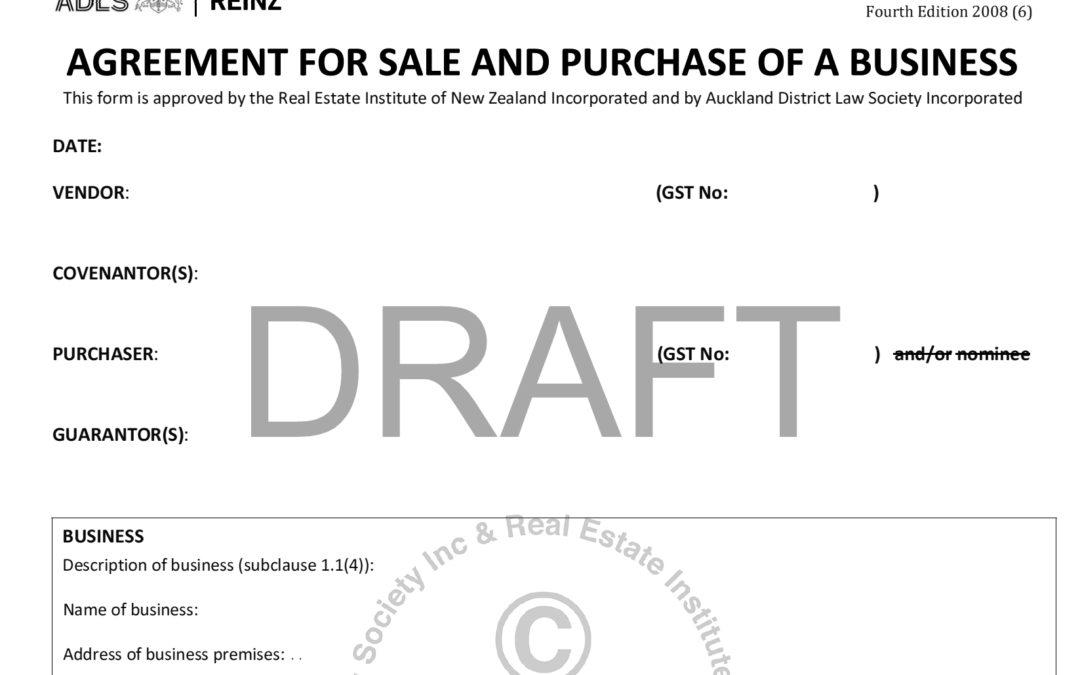

AGREEMENT FOR SALE AND PURCHASE OF A BUSINESS

An ASPB (AGREEMENT FOR SALE AND PURCHASE OF A BUSINESS) is the most common form of SMB (Small to Medium-sized Business) sale agreement in New Zealand. It is an agreement to sell/buy assets used for operating a business identified as Tangible, Intangible, and Stock Assets – excluding creditor liabilities, cash, and debtor assets.

Standard TERMS OF SALE are changed and deleted, and FURTHER TERMS OF SALE are added to account for unique terms of a sale.

Some businesses are sold (in full or in part) as Shareholder Equity, a share (rather than ownership of specific assets) of ownership of the business Those sales normally include most (if not all) assets and liabilities of the limited liability company being sold, including cash, creditor liabilities, and debtor assets.

Agreement-for-Sale-and-Purchase-of-a-Business-Fourth-Edition-2008-6